In the world of forex trading, understanding forex trading pip Best Crypto Apps the terminology is crucial for successful trading. One of the most fundamental concepts in forex trading is the “pip.” A pip, or “percentage in point,” is a unit of measure used to express the change in value between two currencies. This article delves into what pips are, their significance in trading strategies, and how to calculate them effectively.

What is a Pip?

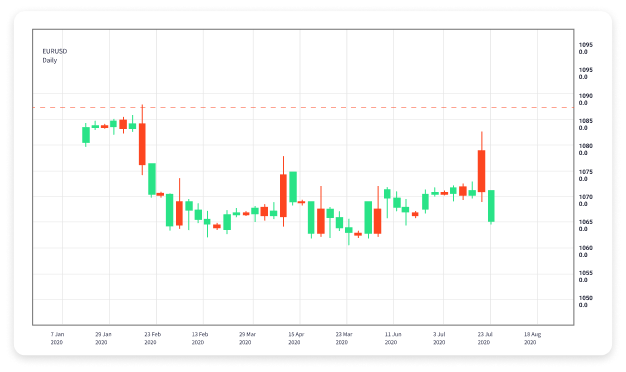

In forex trading, a pip represents the smallest price movement that can occur in the exchange rate of a currency pair. Most currency pairs are quoted to four decimal places, meaning that one pip is equivalent to a one-point move in the fourth decimal place. For example, if the EUR/USD moves from 1.1050 to 1.1051, that 0.0001 USD increase is one pip.

Pips in Different Currency Pairs

While most currency pairs feature four decimal places, there are exceptions. For currency pairs that involve the Japanese Yen (JPY), pips are measured in two decimal places. For instance, if the USD/JPY pair moves from 110.00 to 110.01, that movement represents one pip.

How to Calculate Pips

Calculating pips can be essential for managing profits and losses in trading. To calculate the value of a pip, you need to consider the currency pair you are trading, the size of your trade (lot size), and the exchange rate.

The basic formula to calculate pip value is:

- Pip Value = (One Pip / Exchange Rate) x Lot Size

For example, if you’re trading 1 standard lot (100,000 units) of EUR/USD at an exchange rate of 1.1300, the pip value can be calculated as follows:

- Pip Value = (0.0001 / 1.1300) x 100,000 = $8.85

The Importance of Pips in Forex Trading

Pips play an essential role in forex trading by allowing traders to measure price movements, assess risk, and determine profit margins. Understanding how pips affect your trading account is vital for several reasons:

1. Assessing Market Movement

For traders, the movement of pips helps indicate market trends. Monitoring the direction and size of pip movements can provide insights into whether a currency pair is appreciating or depreciating, which can substantially influence trading decisions.

2. Risk Management

Effective risk management is invaluable in trading, and understanding pips allows traders to set stop-loss orders accurately. By knowing how much of their account they risk per pip movement, traders can strategically place their stop-loss orders to minimize potential losses.

3. Calculating Profit and Loss

When entering a trade, traders can use pip calculations to forecast potential profits and losses. By knowing the pip value and the distance of your entry point to your exit point, you can effectively strategize your trades and improve your overall profitability.

Different Types of Lots and Their Pip Values

Understanding how lot size affects pip value is crucial for accurate calculations. There are three main types of lots in forex trading: standard lots, mini lots, and micro lots.

- Standard Lot: 100,000 units of the base currency. The pip value for a standard lot is typically $10.

- Mini Lot: 10,000 units of the base currency. The pip value for a mini lot is approximately $1.

- Micro Lot: 1,000 units of the base currency. The pip value for a micro lot is about $0.10.

Understanding these differences helps you tailor your trading strategy according to your risk tolerance and capital allocation.

Using Pips in Trading Strategies

Many traders utilize pips as a fundamental metric while implementing various trading strategies. Here are a few strategies where understanding pips can enhance trading performance:

1. Scalping

Scalping involves making numerous small trades throughout the trading session to accumulate pips quickly. Understanding pip movement is critical for scalpers, as their primary goal is to exploit small price fluctuations for profit.

2. Day Trading

Day traders aim to capitalize on intraday price movements, often holding positions for a short time. For day trading, having a firm grasp of how many pips are at stake in each trade can help manage expectations and set realistic profit targets.

3. Swing Trading

Swing trading involves holding positions for several days or weeks to capture larger price movements. By analyzing pip movements, swing traders can gain insights into market trends and optimize their trade entries and exits.

Common Mistakes in Understanding Pips

Despite the importance of understanding pips, many beginners make common mistakes:

- Miscalculating Pip Value: Ensure you calculate pip value correctly, as miscalculating can significantly impact your risk management strategies.

- Ignoring Spread: The spread (the difference between the buying and selling price) can affect your profit margins and should be factored into your pip calculations.

- Not Adjusting Lot Sizes: Failing to adjust your lot size based on your pip risk can lead to higher losses than intended.

Conclusion

Pips are an essential element in forex trading, providing a metric for measuring price fluctuations, assessing risk, and enhancing trading strategies. A thorough understanding of pips not only equips traders to make well-informed decisions but also enhances their overall trading experience. By familiarizing yourself with how to calculate pip value and integrate it into your trading strategy, you can significantly improve your chances of success in the dynamic world of forex trading.

Whether you’re a novice or an experienced trader, mastering the concept of pips is fundamental. Begin implementing pip analysis in your trades and see how it can transform your approach to forex trading.